Shifting the risk of social value creation to private investors

There is currently much discussion about the Social Impact Bond as an innovative tool to generate financing for social enterprises. Anyone who has tried to start a social enterprise—a business that exists for the primary purpose of addressing a social need—knows that it is challenging to find the financial resources to start operations.

This financing challenge is even more acute in nonprofit organizations, where there may be little collateral, nobody to guarantee a loan, and little, if any, operational reserves.

What is it?

The Social Impact Bond mechanism originated in the UK, where the social enterprise sector is arguably 10 to 15 years ahead of the sector in Canada. A similar model has been replicated in the US (also referred to as a “pay for success” or “payment-by-results” bond) and now the Social Impact Bond is part of the Canadian discussion, particularly at policy and government circles.

In short, the Social Impact Bond is a mechanism that allows for three parties to become involved in financing innovative solutions to social needs or social problems: the government, private investors and the social service sector. The mechanism also requires a fourth party, an independent intermediary, to choreograph the process and to select the service provider (in the UK model) to undertake the work.

The Need

Government is expected to address social concerns, but is challenged by the high cost and complexity of successful local or regional programming. Private investors are growing increasingly interested in responsible investing where they can get a financial return on their investment by supporting worthwhile causes. Social service delivery actors, typically nonprofits corporations and the subset of those which are registered charities, work diligently to address social concerns and social causes; yet they are frequently underfunded, in spite of often proven good work.

Traditionally, government has addressed their social service mandate, in part through direct funding to nonprofits and charities. This is a current expense for governments in a time of dwindling budgets, and there appears to be a concern that granted public funds may not be measurably changing the social landscape.

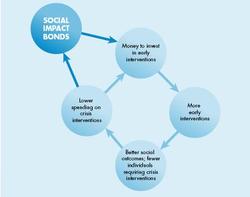

The Social Impact Bond, by comparison, invites private investors to provide the money for the social service agencies to do their work and the government then promises to pay the investors back, with interest accrued, if the service agencies are able to demonstrate measurable changes in a social problem.

The intermediary organization is an independent body that collects the money from investors, makes and tracks the investment in the community agencies, confirms (or denies) that the money is in fact making a measurable difference, and then documents the social change to allow the government to pay back the investor as appropriate.

What is good about Social Impact Bonds:

- Social service programs receive necessary operational money up front.

- It forces social service agencies to proactively measure and communicate their social impact. The whole concept relies on effectively measuring social change.

- Current budgets of government do not expand, even though social service delivery expands. Indeed, the government pays out nothing until the social change is achieved and measured.

- Private investors get an inside look at social problems and an opportunity to become involved in the innovative solutions that are being developed in the social economy.

- New money (from the private sector) comes into the social service sector in the short run.

- The Social Impact Bond is tied directly to social return on investment, rather than mobilizing resources for the limited number of social enterprises that will offer only a financial return on investment.

What is problematic about Social Impact Bonds:

- The cost to the public purse, though deferred, of any given successful social program will be larger than a traditional grant, as it must include the fixed costs of the intermediary, the financial ROI to the investor (typically 5-9% pro-rated to reflect the degree of social change realized), AND the return of the initial investment to the investor.

- Private investors shoulder all the financial risk, and yet have limited power to govern the social service agency/collective work. Indeed, the “failed” projects end up saving the government money, and punish the private investor.

- In Canada we have only just started to develop and understand the tools for measuring social impact, which means the key to this whole investment mechanism relies on an imperfect understanding of success.

- The social service agency gets paid to do the work, but they need to prove causality in typically very complex social challenges (See a 2013 article in the Stanford Social Innovation Review on the challenges of evaluating Social Impact Bonds). Factors beyond the scope of the investment are very likely to affect the social outcome. Moreover, having a control group—that is to say an identical population of people in need but who don’t get the intervention—is both challenging, and ethically questionable.

- There may be an incentive to invest in easy to measure short-term social outcomes rather than intractable or complex social concerns. For example, this mechanism might favorably fund a project to create housing units for low income families in a given year, but is unlikely to invest in education projects that take 10 years to address fundamental causes of poverty in the first place.

- The “model” upon which this mechanism is based has not yet been proven to work in either the UK or the US. There are less than 20 active “deals” initiated since 2010 worldwide to serve as guidance and there are no definitive conclusions about the effectiveness of this mechanism in achieving improved social outcomes.

For more on Social Impact Bonds, read:

Realizing Value Through Social Impact Bonds

In Conversation with Antony Bugg-Levine

Goldman Sachs, hedge fund billionaire back $27M social impact bond

{jcomments on}

Jonathan Wade is a social enterprise sector developer based in Ottawa, working with the Centre for Innovative Social Enterprise Development (CISED). He works directly with social entrepreneurs, co-ops, and nonprofits on social enterprise business development, from ideation to planning to design and launch, including advising on social finance options. All opinions in this article are his own, and are based upon his experience with a diverse client base of social entrepreneurs.

B Corp certification is distinct from the benefit corporation form of business that is legislated in many U.S. states.