With the recent Biden Administration announcement to reduce U.S. Greenhouse Gas (GHG) emissions by 50-52 percent below 2005 levels by 2030, there is an urgent need for solutions across multiple sectors to meet this ambitious goal. Food systems are leading contributors to climate change and account for over one third of estimated global GHG emissions. Approximately one-third of the world’s food is lost before it reaches a consumer and food waste specifically comprises an estimated 8-10% of global GHG emissions. As such, the Intergovernmental Panel on Climate Change (IPCC) has identified reducing food waste as a key initiative for reducing GHG emissions.

Prior to the announcement of the new U.S. Nationally Determined Contribution, many consumer packaged goods (CPG) companies set aggressive targets to transition to net-zero emissions across their supply chains by 2050 or sooner, such as PepsiCo, General Mills, and Unilever. While reducing food waste presents a high potential solution to meet these goals, it’s currently underleveraged as part of the climate action plans set forth by many CPG companies.

One reason for this is the lack of food waste data and an inability to measure progress toward reducing waste. Without the ability to track and monitor outcomes from waste reduction strategies, food waste is overlooked as part of the solution to achieve corporate climate goals.

To address this gap, Crisp, developer of the first programmatic commerce platform for the food industry, is working with CPG companies to improve food supply chain data access and visibility to minimize waste and improve profitability. This includes a new retail waste metric the company developed to help customers track progress toward their sustainability goals.

How to measure progress on retail food waste

Understanding the amount of retail waste that is occurring in the supply chain is a common challenge for many CPG companies. Not only is it difficult for food manufacturers to quantify the amount of waste that is occurring, accessing this information in time to do something about it presents another key obstacle. A food brand may supply thousands of retailers, adding complexity to the need for timely, actionable data on potential mismatches between food supply and demand to reduce waste and corresponding GHG emissions.

Crisp works to address this disconnect by using signals from the supply chain, sales, and inventory to help food manufacturers predictively match supply and demand in a way that eliminates the need for overproduction, over-delivery, and resulting waste. To support CPG brands with measuring and managing retail food waste, Crisp developed a new tracking system and waste metric that leverages retailer data. Companies can then use this data to track and monitor progress toward a variety of sustainability goals, including quantifying the corresponding reductions in GHG emissions from food going to landfill.

Retail food waste can be calculated and managed through the following steps:

1. For each product, compare sales, shipment, and inventory inputs to identify product that has spoiled or is at risk of spoiling. A given product’s waste is calculated as a percentage of overall product inventory.

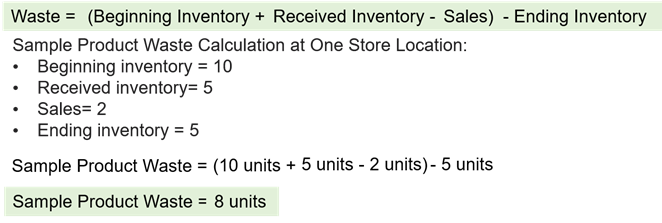

The following sample analysis illustrates the equation Crisp developed that CPG brands can leverage to calculate retail-level waste.

Figure 1: Sample Waste Metric Calculation

2. Generally, spoilage incidents can be spotted ahead of time and mitigated, which will reduce waste and improve the overall score.

3. In addition to calculating waste, brands can use a life cycle assessment (LCA) to adjust for the product’s unique emissions profile. For example, products that require refrigeration would likely be weighted higher than a shelf-stable product because of the higher energy needs during transport.

Translating reduced waste into sustainability goals

An improved ability to measure retail waste is enabling multiple Crisp clients to track and manage progress toward their ambitious sustainability goals. For example, Greenleaf Foods recently partnered with Crisp to leverage dashboards that can easily pinpoint potential inventory gaps and improve their ability to reduce waste, an important part of Greenleaf’s sustainability plan. “As one of the largest carbon-neutral CPG companies, we worked together with Crisp to develop a spoilage tracker to further our commitment to sustainability,” said Adam Moleta, key account manager for the natural channel at Greenleaf Foods. “With increased visibility into inventory levels, we’re now able to recover potential losses and reduce waste.”

Crisp is also working with Fullgreen to track and manage retail food waste. “We’re committed to reducing waste of our final product along the retail chain, and data is critical to this effort,” said Gem Misa, CEO of Fullgreen. “By monitoring the data, we can more easily prevent spoilage and track progress toward our overarching sustainability agenda.”

The ability to more accurately forecast ingredient needs is another key benefit of improved retail waste tracking. “We use data to reduce food waste by tracking our monthly sales and store counts,” said Tiffany Perkins, founder, chef & CEO of Plant Perks. “This helps us forecast how many ingredients to order at a time to meet demand for the next three months. We order ingredients in three month increments to make sure nothing expires and goes to waste.”

The path ahead

Reducing retail food waste can be part of the solution to achieve climate goals, but companies must first be able to measure it to help identify and prevent possible waste from occurring. By aligning food waste reduction efforts with day-to-day business operations, sales, and marketing activities, CPG companies can address the root cause of retail food waste, which is an imbalance between supply and demand. Many factors influence food waste, but by setting actionable waste metrics and translating the data into progress against sustainability goals, food companies can take an immediate and measurable step toward emissions reduction today.

Founder and CEO of Crisp, Are Traasdahl has more than 20 years of experience in mobile and digital technology. Prior to Crisp, Are was the Founder & CEO of Tapad Inc. In 2016, Telenor Group acquired Tapad for $360M, making it the fifth largest venture-backed M&A exit in New York since 2009. Prior to Tapad, he founded Thumbplay, a mobile entertainment service that he grew to more than $100M in revenue in less than 3 years before he exited the company. The company, later acquired by Clear Channel, is now called iHeartRadio.

Traasdahl is a frequent contributor for outlets such as CNBC and Bloomberg News, and he has been featured in Forbes, the Wall Street Journal, Ad Age and other major news publications. He was named Global Startup Awards™ Founder of the Year in 2016 and EY Entrepreneur of the Year in 2014.