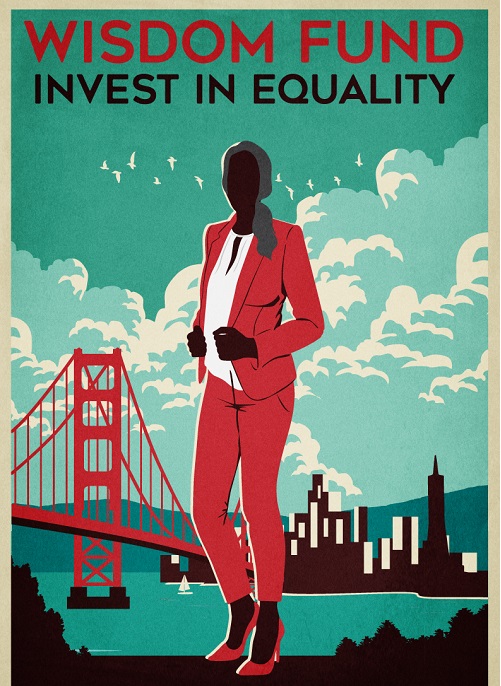

Women are the fastest-growing group of entrepreneurs in the U.S. Yet less than five percent of small business lending – only about $1 in $23 – goes to women. CNote, an Oakland-based fintech firm, is looking to fix this disparity with the Wisdom Fund, a new impact investment opportunity that enables individuals and institutions to invest in the future of women.

Created in partnership with mission-driven lenders, the Wisdom Fund funnels money from accredited investors – institutions, funds, foundations, family offices and individuals – into business loans for low- to moderate-income women and women of color. Investors in the Wisdom Fund will earn an estimated four percent annual return over a 60-month term.

The loans are provided by nonprofit community lenders with decades of experience delivering the capital and resources that women small business owners need. The Wisdom Fund isn’t only about making more loans. The initiative provides business support and coaching services and will be working with local stakeholders to gather data on ways to improve the lending process for women-owned businesses.

Fixing a social injustice

“We hear a lot about the gap in venture capital funding for women, but the vast majority of women who need capital are not forming hyper-growth startups; they are starting small businesses to pursue economic freedom, flexibility and independence,” said Catherine Berman, CEO and co-founder of CNote. “The financial system is not serving them well, and we’re very much failing women of color in particular.”

“With the Wisdom Fund, we’re taking a major step toward fixing a huge injustice—women’s businesses receive far less funding than they deserve,” she said. “We’re working with an amazing group of nonprofit community lenders nationally to entirely rethink lending to women.”

During a three-phase build-up, Wisdom Fund partners will collect, share and act on data about what works for women entrepreneurs. In the first eight months, participants will fill in the knowledge gap, gathering information on how women interact with the loan process, what hangs them up and what eases their path. In phase two, the partners will experiment with new ways to serve women that remove barriers. Around the one-year mark, the focus will shift to scaling the program by continuing to add new lending partners, increasing investment and implementing best practices across the network.

When women have equal access to capital, we all win

According to a report from the Association for Enterprise Opportunity, the median net worth for black business owners is 12 times higher than black non-business owners. Given CNote’s overarching mission of closing the wealth gap in America, the Wisdom Fund is a step towards helping female entrepreneurs, especially those of color, create and keep wealth in their communities.

Shavon Marley, for example, is the owner and founder of Marley Transport & Trucking in Raleigh, North Carolina. She worked with a CNote partner, Carolina Small Business Development Fund, to get a loan that turned her small business vision into a reality. Carolina Small Business didn’t just provide capital; they helped Shavon refine her business plan, along with providing coaching and other resources along the way. Only a few months after founding, Marley Trucking expanded, hiring additional employees to keep up with growing demand. This is an example of the multiplicative effect small business lending can have, where a loan like this not only positively impacts the recipient, but the community the business operates in as well.

CNote and their partners believe that increased lending to female entrepreneurs can usher in a new era of economic activity. Indeed, the 2018 State of Women-owned Businesses Report noted that if revenues generated by minority women-owned firms matched those currently generated by all women-owned businesses, they would add four million new jobs and $1.2 trillion in revenues to the U.S. economy.

When women have equal access to capital, we all win.

Mike Ivancie is the Director of Growth and Partnerships at CNote. In that role, Mike works to introduce impact investing to both individuals and institutions, helping them align their investments with their values.